Tax reform

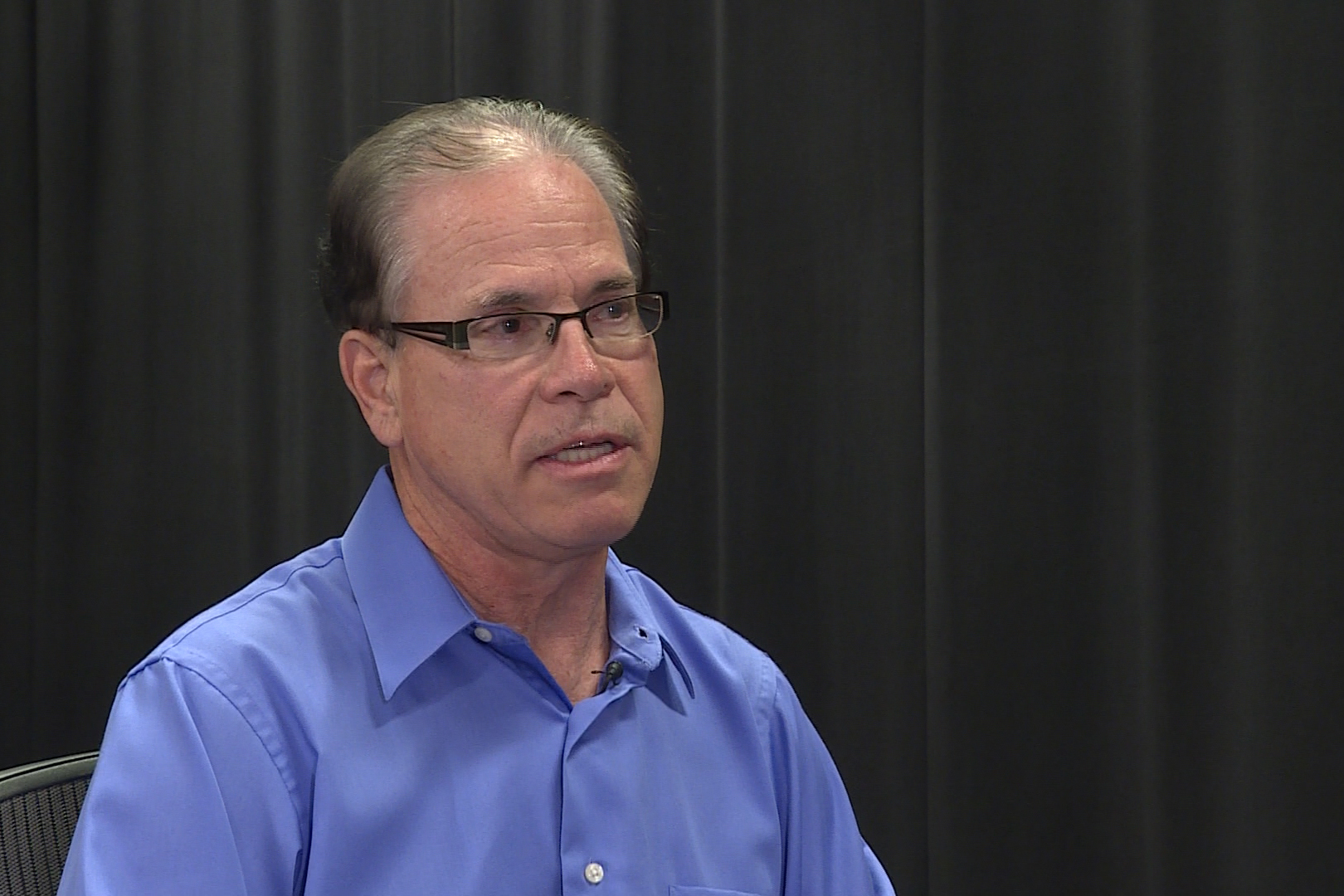

Mike Braun, Republican

"When you cut taxes, you're going to generate to generate more economic activity. It gave businesses and especially small ones, the job creators — it gave us, if you were successful in paying taxes, more jingo in your pocket. We need to share it with our employees; you don't hear many conservatives saying it."

"Nancy Pelosi referred to it as crumbs. And now, incrementally, just through lower withholding that’s approaching the $1,200 to $1,500 for the average middle-income taxpayer. They are now saying, ‘Yes, I can feel it, it’s been there, it’s real.’"

Lucy Brenton, Libertarian

"I will vote for anything that increases freedom and reduces cost. So, I would’ve voted for it but I don’t think it went far enough. When I reviewed it, it looked like Trump took from 35 to 21 percent on the corporate income tax. That’s great; that means that consumers are going to pay less. But it’s not nearly good enough."

Joe Donnelly, Democrat incumbent

"It would be like the parents going out on a shopping spree and giving the kids in the house the bill. No parent would ever do that. That’s what this tax bill was. I’m not in the business of piling up huge debt for our kids in order to give huge tax breaks to the very, very richest people in our country."